nd sales tax exemption form

It provides information the partners may need to complete their North Dakota income tax returns. Check this box if this exemption certificate is being.

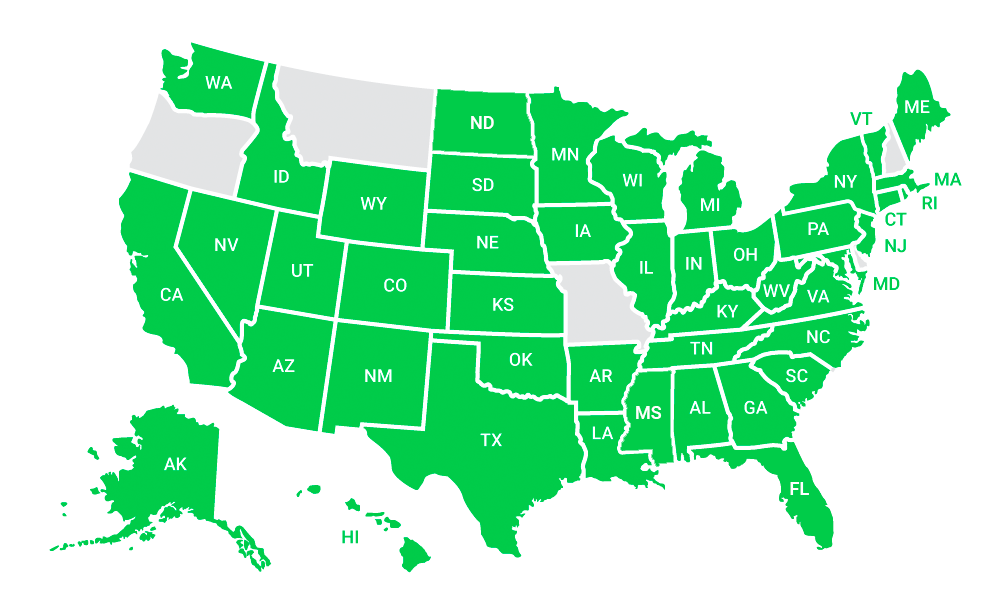

Sales Tax By State Is Saas Taxable Taxjar

Showing 1 to 3 of 3 entries.

. Get more for nd sales tax refund form. Name and physical address of the project. Exemption year requested form.

The taxable price of each piece of exempt equipment must be at least 2000. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. Each Tax Administration Practice is in the Library of Tax Administration Practices in the Streamlined Sales and Use Tax Agreement SSUTA as amended through December 21 2021.

Who should use this form. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Exempt Production Activity Items.

Forget about scanning and printing out forms. If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. I further certify that I will report and remit any sales or use tax and any penalties which attach as a result of purchases from.

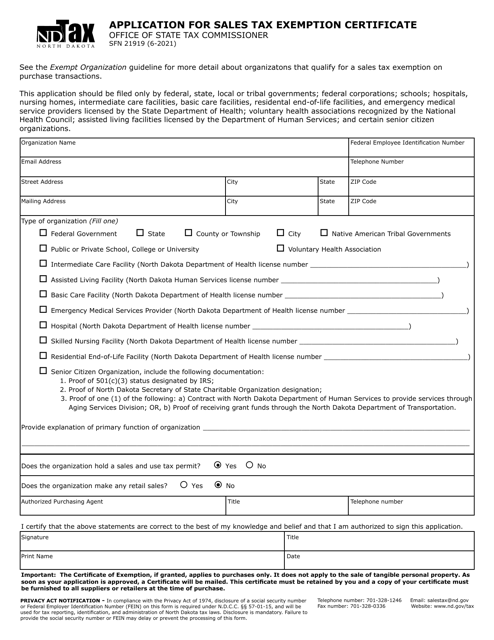

This application should be filed only by federal state local or tribal. Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. The letter should include.

Georgia Not Exempt NA Hawaii No state sales tax NA No sales tax but a gross receipts tax excise tax on gross income from. Contact our office for details. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND 58104-7535 7012397165.

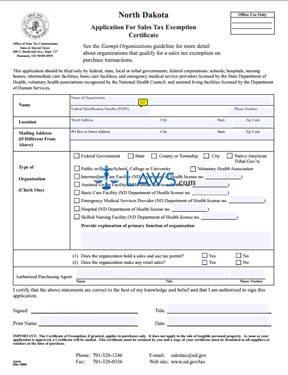

Application for Sales Tax Exemption Certificate. Send the completed form to the seller and keep a copy for your records. Single purchase exemption certificate.

Purchasers Affidavit of Export Form. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US. If you are a North Dakota resident individual estate or trust your entire.

Fact sheets are available for some of the items as noted. This is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a processing facility in North Dakota that produces liquefied natural gas. To qualify for the exemption the vendor must operate a substantial grocery or market business as defined in Section 11-206 a of the Tax-General Article at the same location where the food is sold.

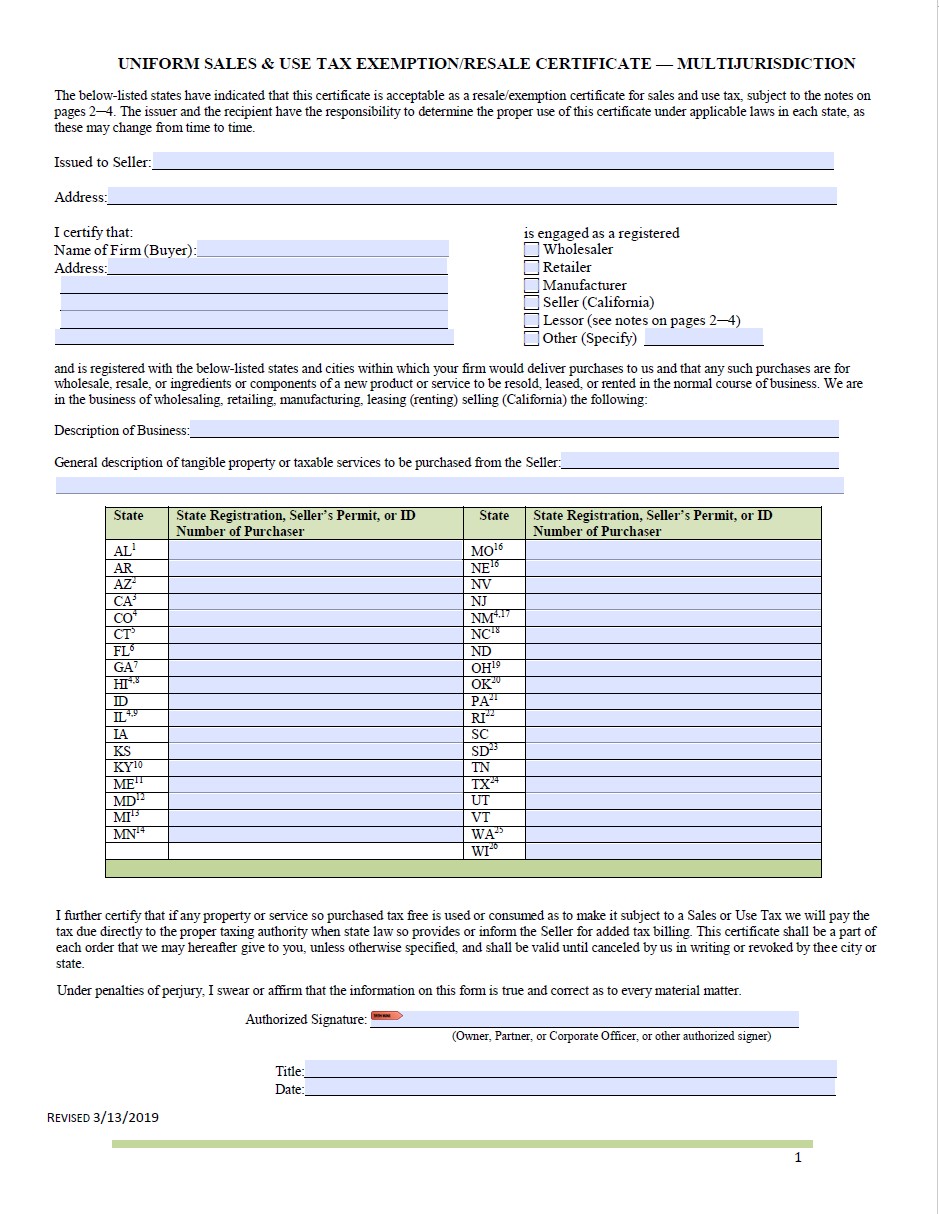

For example if you are claiming an exemption from sales or use tax imposed by the state of North Dakota enter ND in the boxes provided. Streamlined Sales and Use Tax Certificate of Exemption Form. Resident individual estate and trust.

OFFICE OF STATE TAX COMMISSIONER. Purpose of form North Dakota Schedule K-1 Form 58 is a supplemental schedule provided by a partnership to its partners. Uniform Sales Use Tax Certificate - Multijurisdictional Form.

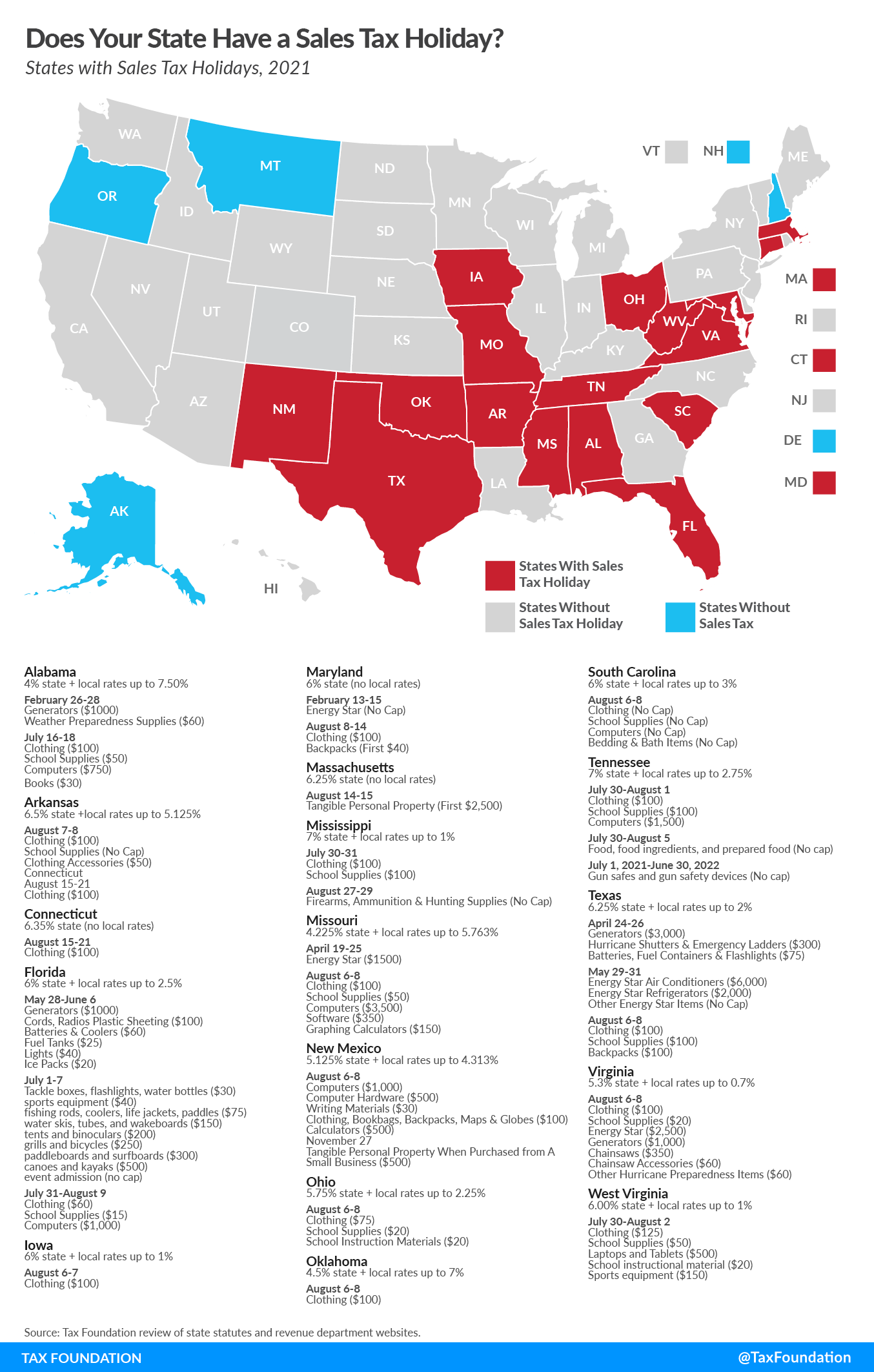

Many states have special lowered. You may be required to provide this exemption certificate or the data elements required on the form to the state to verify this exemption. SFN 21919 6-2021 See the Exempt Organization guideline for more detail about organizatons that qualify for a sales tax exemption on purchase transactions.

I am engaged in the business. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Provide a copy of the Consumers For hotels.

For other North Dakota sales tax exemption certificates go here. Sales Tax Exemptions in North Dakota. APPLICATION FOR SALES TAX EXEMPTION CERTIFICATE.

Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. Provide a copy of the Exempt Organizations Attestation of Direct Billing form. North Dakota residents to pay use tax on goods purchased tax free from out-of-state sellers.

For purchases made by a North Dakota exempt entity the purchasers tax identification number will be the North Dakota Sales Tax Exemption Number E-0000 issued to them by the North Dakota Office of State Tax Commissioner. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

What Is A Sales Tax Exemption information registration support. Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax.

In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now. How to use sales tax exemption certificates in North Dakota.

08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities. If you are claiming exemption for more than one member state complete the SSUTA Certificate of Exemption. Include items listed in the Sales Tax Exemption Application Approval Requirements.

You can download a PDF of the North Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page. Form 301-EF - ACH Credit Authorization. TRIBAL CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle SFN 18085 5-2016 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND 58505-0780 Telephone 701 328-2725 Website.

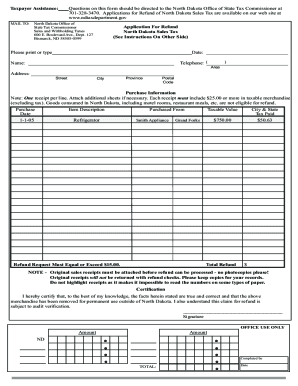

OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____. The One Time Remittance form is for one-time sales and use tax remittance only. Quick guide on how to complete north dakota sales tax refund claim form.

Ad New State Sales Tax Registration. Exemption descriptions Use Form ST3 Certificate of Exemption to claim the following exemptions. State of south carolina department of revenue abl renewal form.

Use our detailed instructions to fill out and eSign your documents online.

Sample Letter Requesting Sales Tax Exemption Certificate Regarding Resale Certificate Request Letter Templa Lebenslauf Anschreiben Lebenslauf Lebenslauf Muster

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

Sales Tax Campus Controller S Office University Of Colorado Boulder

Form 21919 Application For Sales Tax Exemption Certificate

Sales Tax Campus Controller S Office University Of Colorado Boulder

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Sales Tax Campus Controller S Office University Of Colorado Boulder

Understanding Sales Tax With Printify Printify

What Is A Sales Tax Exemption Certificate And How Do I Get One

What Is Sales Tax Nexus Learn All About Nexus

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

State Corporate Income Tax Rates And Brackets Tax Foundation

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow